AI, Insurance, and the UN SDGs: Building a Sustainable Future

Mind Foundry has been working alongside Aioi Nissay Dowa Insurance and the Aioi R&D Lab - Oxford to create AI-powered insurance solutions whose...

6 min read

Mind Foundry

:

Jul 13, 2023 11:21:34 AM

It’s hardly a secret that data is the lifeblood of the insurance sector. Some experts predict there will be over 30 billion connected devices worldwide by 2025, and the resulting explosion of data, coupled with huge leaps forward in the capabilities of AI and machine learning, has already begun having an effect on the insurance industry.

We have seen Lemonade process a claim in only 2 seconds, and companies like Roots Automation exploring the use of Generative AI to improve customer service. But despite these advancements, many insurers still need to improve the bottom line as they experience a deceleration in the release of prior-year loss reserves and watch underwriting performances deteriorate in a post-Covid world. Access to data and the availability of new technology are not the issues, so why are so many insurers fundamentally failing to leverage new technology to tap into the potential of their data?

Systemic Obstacles

Across all lines of business, insurers are failing to exploit data to its full potential despite the fact that tools like AI and machine learning have already proven their worth in this space. In underwriting, for example, an Accenture report noted that “although interest in and use of big data is expanding, still only around 30% of insurers are currently fully leveraging it”. When we look at how most large insurance organisations are set up, there are clearly some systemic obstacles preventing them from using AI and machine learning to get the most out of their customers’ data.

One such challenge is the pressure on insurers to significantly reduce operational costs without negatively impacting their products and services. The margins in insurance are inevitably fine, which means that reducing costs goes hand-in-hand with generating profits by necessity. AI can clearly add real value in this space. As the Accenture report notes, “an enterprise approach to tools like AI and automation has the potential to deliver a 30-40% cost reduction”.

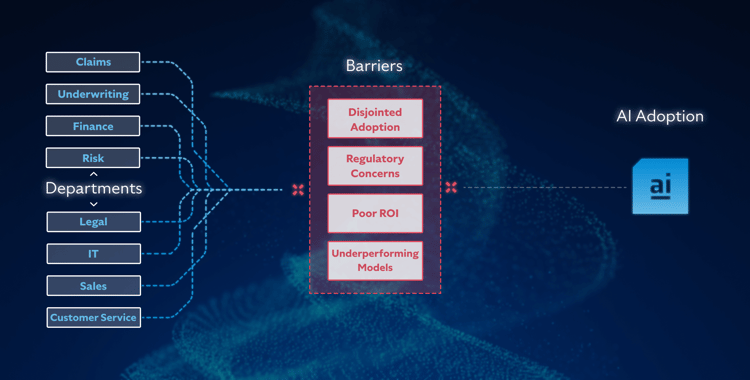

However, the compartmentalised nature of many large insurance organisations is holding back actual procedural and strategic change. Too few organisations possess these qualities when it comes to AI adoption. Equally problematic is the fact that too many insurers lack a strategic approach to AI adoption, which means that what AI systems they have adopted end up siloed across different departments and business lines, acting more as individual R&D projects than strategic initiatives to drive growth and provide actual ROI.

Economic Challenges

The current economic climate is also having a huge ripple effect on the insurance industry. According to the Financial Times, “UK motor insurers suffered their worst underwriting performance in a decade last year as spiralling claims and other costs far exceeded premiums, with further losses expected in 2023 as providers struggle to recoup the expense of inflated payouts”. The cost of second-hand cars, parts, and labour have skyrocketed, further eviscerating the already small margins in motor insurance and leading to increased claims costs across the industry. Customers will also inevitably feel the effects of these changes in the form of increased insurance premiums as insurers struggle to rebalance their books, with EY predicting a price rise of 11% in 2024 to go with the rise of 16% that we’ve seen already this year. Across the insurance industry, wherever you look, you can see evidence of how this economic downturn is having a real and lasting impact and how insurers are desperate to find ways to mitigate these effects.

Regulation on The Horizon

The final and perhaps most significant obstacle is the fundamental concern around the data itself. Insurers have access to vast volumes of customer data, but this data comes with complicated strings attached. The way insurers collect, process, store, and use this data is subject to specific rules and regulations, and as data volumes increase and the tools to process it increase in potency, these rules and regulations are becoming increasingly stringent. With the publication of the EU’s AI Act and the UK Government soon to follow with its own set of regulations around AI, much of the concern within the insurance industry revolves around how to maintain compliance with these regulations whilst successfully integrating AI into their business and their data. Although the challenge of adopting AI to extract value from data whilst maintaining regulatory compliance is a difficult one, there is a framework for AI adoption that can help ensure success if organisations commit to it.

Adopting the Right Approach

The first step to adopting AI in a way that successfully addresses these obstacles is to take the correct approach from the start. To extract real value from data with successful AI adoption, you must think clearly and strategically before you make decisions. The mistake that some make is to think that because they already have access to vast volumes of data, they will begin to see immediate rewards by simply adopting AI in some form. This results in a landscape of disjointed providers selling off-the-shelf, pigeonholed solutions that bring limited tangible benefits and competitive advantage. Not only that, but these solutions can carry risks around data protection and compliance if they aren’t explainable in how they use customer data and the outputs they’re providing us with to make decisions. Alternatively, some insurers hire consultants to build custom solutions or co-op internal teams, but these also come at a very high price and are frequently challenging to maintain post-deployment. In short, if you start with the wrong approach to AI adoption, you will end up with the wrong results.

Instead, it’s essential to start with a “problem-first” approach. Start by collaborating across departments and job roles to establish where in the business you are failing to get the most out of your data, where the problem is at its most severe, and how quickly a solution can be devised and integrated. Working this out is the first step to finding the AI solution to these problems, but you don’t have to do it alone. An effective way to start is with use case discovery in close collaboration with the operators at the business end of the problem. They bring the relevant data and experience, and by pairing that with the right AI expertise, you can identify the areas where AI and machine learning have the potential to bring the most value. Not only can you start solving problems this way, but effective use case discovery can help you find and address problems that you might not even have been aware of before. This is what makes it so essential in order to scale AI throughout an organisation.

Finding the Right Solution

Problem identification is the first critical step to successful AI adoption. But once you’ve identified where you are failing to translate your proliferation of data to business value, then you need to find the right solution to this problem. The importance of getting this right can’t be overstated. The problems around insurance data are nuanced and pervasive, and solutions must be customised to suit the problem and the data they are dealing with. This is before you factor in the looming spectre of increasing regulations on the horizon as governments scramble to match regulatory requirements with the pace of advancements in AI. Failure to comply with current and future regulations can have dire consequences for insurers, through financial penalties but also through the significant reputational damage that can ensue from failure to protect customer data.

You need to find an AI partner that not only understands these issues but has the resources at their disposal to enable you to resolve them. This is why off-the-shelf solutions aren’t always up to scratch. Many are ineffective, black-box models that either don’t perform, decay quickly, are insufficiently transparent or are a combination of all three. If you don’t know how a model came to generate its outputs, then you can’t be certain that the model is secure or unbiased in its usage of data. Equally, in an industry where new data is constantly being generated and incorporated, model performance post-deployment is an essential consideration. Machine Learning models can fail due to a variety of factors, and when this happens, you can’t afford to find out long after the fact. The damage may already have been done. This means that systems for model governance that give real-time feedback on model performance have quickly become integral to the success of AI adoption in insurance.

Keeping It All Together

Being able to monitor the performance of an individual Machine Learning model is important, but it is not enough. To drive real business value, you will need a comprehensive portfolio of customised models performing a variety of functions across your organisation, and you will need to be able to manage all of these models effectively and efficiently, as well as build and integrate new ones when the need arises. This sounds simple in theory but is actually incredibly challenging in practice. Most large insurance organisations either have disjointed and siloed AI adoption, or their models are underperforming and not bringing any real value. For many, it’s both.

Technological capabilities like those provided by the Mind Foundry Platform allow for the building, deployment, management and monitoring of a portfolio of models in a unified environment. The simplification and ease of use that this enables can go a long way to unlocking the full potential of insurance data with AI, as it is no longer necessary to have multiple teams with multiple open consoles in order to coordinate model management. In an industry of constant change, the ability to adapt your technology to your changing needs is one of the fundamental keys to success.

Ongoing Collaboration for Continuing Success

Adopting AI is more complex than buying and integrating software. Successful AI adoption requires a strategic and nuanced approach that necessitates collaboration because possessing all the necessary data, technology, and skills within a single organisation, even a large insurer, is practically unrealistic.

Instead, your goal should be to find the right partners who understand your data and your problems and can marry these with their AI capabilities and data science expertise. AI’s potential to truly maximise the potential of insurance data is self-evident. We have myriad examples of it aiding fraud detection, driving growth, cutting costs, and improving efficiency. But if your goal is to use AI as a spearhead to drive the digital transformation of your entire organisation, then the time to devise strategies, make decisions, invest in infrastructure and drive changes with this fact in mind is now.

Enjoyed this blog? Check out Insurance and Generative AI: Seeing Past the Headlines.

Mind Foundry has been working alongside Aioi Nissay Dowa Insurance and the Aioi R&D Lab - Oxford to create AI-powered insurance solutions whose...

Local authorities need to support their funding requests with high-quality data. The problem is that they can't obtain this data at the required...

The UK-USA Technology Prosperity Deal sees overseas organisations pledging £31 billion of investment into UK AI infrastructure. As AI investment...